Airport Parking Reservation Systems and Techniques (2025)

Chapter: 3 Survey Summary Findings

CHAPTER 3

Survey Summary Findings

3.1 Survey Overview

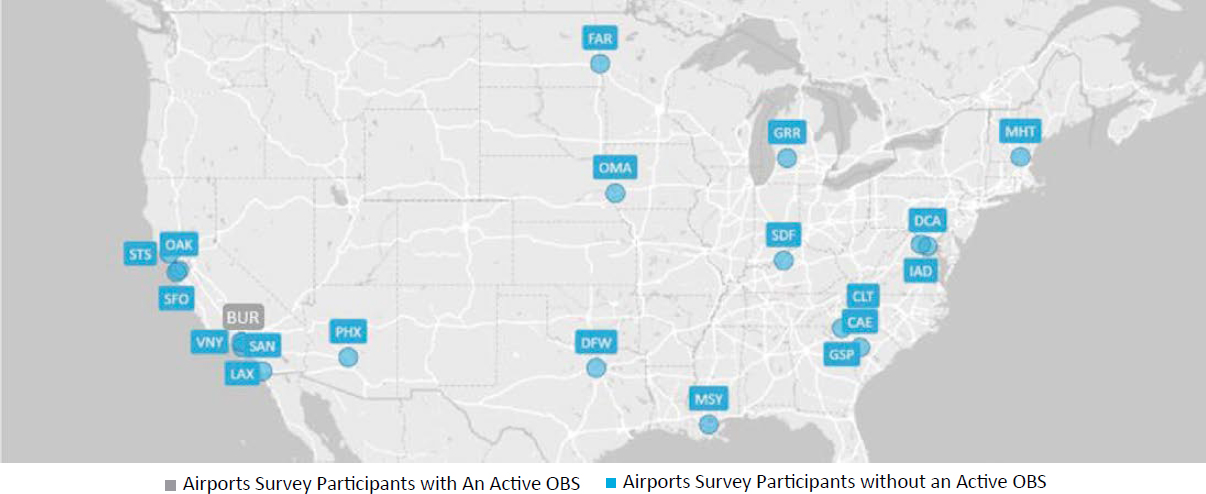

This chapter summarizes the survey findings. A total of 18 airport operators representing 20 airports participated in the survey, which was conducted from December 2023 to April 2024.

Figure 3.1 illustrates the airports that participated in the survey. Burbank-Glendale Airport Authority, owner and operator of Hollywood Burbank Airport (BUR), participated in the survey but removed its OBS in 2023. At the time of the survey, the airport no longer had an active OBS. In follow-up conversations with BUR, it was indicated that the airport is in the process of procuring a new OBS vendor. Therefore, for the purposes of this synthesis, the number of applicable airport operators is 17.

3.2 Key Findings

Six key findings were identified from the survey:

- Airports employ a variety of OBS management models.

- The principal benefits identified by most airports surveyed include improving customer experience, providing future demand data, improving utilization, and obtaining customer data.

- Most airport operators surveyed were satisfied with their OBS.

- Not all airports reported evidence of improved revenues as a direct result of using an OBS.

- Airport operators reported a wide range of capital and operating costs.

- A minority of airport operators surveyed offer ancillary parking-related services.

The remainder of this chapter describes each finding in further detail. A detailed analysis of the survey, including a full list of respondents, the questions asked, and the responses to each question, can be found in Appendix B.

3.2.1 Airports Employ a Variety of OBS Management Models

There were two identified OBS management models that are employed by airport operators.

- Part of parking operations contract: Airports such as Los Angeles International Airport (LAX), PHX, MSY, and STS have OBSs as part of a broader parking operations contract. In this model, the parking operator is responsible for the procurement, operations, and day-to-day management of the OBS. This approach allows airports to outsource labor associated with day-to-day system management to a third-party operator, which would have expertise in commercial parking management. However, airports rely on the terms of the contract and their parking operator if they need to make changes and improvements. Airports such as PHX have had success in implementing incremental improvements and functionality additions to the OBS using this OBS management approach.

Source: U.S. Bureau of Transportation Statistics 2024

Figure 3.1. Airports that participated in the survey.

- Direct OBS contracting and management: Airports such as CAE, DFW, and GSP directly procure an OBS vendor. At these airports, in-house airport staff are responsible for OBS day-to-day management and operations. This model allows staff to respond quickly to operational conditions and make real-time OBS inventory and pricing changes to balance occupancy and increase revenue. However, at both GSP and DFW, airport staff have acknowledged that more sophisticated applications, such as dynamic pricing, would require additional staffing or external contractors to assist with implementation and management.

Other hybrid approaches may exist, such as the airport outsourcing revenue management of the OBS to a separate consultant or contractor. At the time of the interview, this outsourcing was being considered at GSP to facilitate implementation of more sophisticated revenue management. Ultimately, the choice of OBS management model depends on the airport’s goals and objectives for the system.

3.2.2 Improving Customer Experience, Providing Future Demand Data, Improving Utilization, and Providing Additional Customer Data Were Top Benefits for the Majority of Airports Surveyed

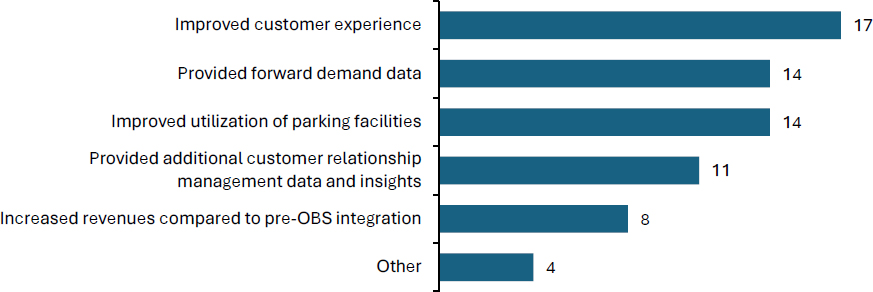

From seven choices, survey respondents were asked to identify the benefits an OBS system provides the airport. Figure 3.2 illustrates the top four benefits, which each had at least eight survey responses.

All 17 applicable airport operators indicated that improved customer experience was a key benefit of implementing an OBS. As further discussed in Chapter 4, especially for airports with high parking occupancy, providing customers a guaranteed space at the parking facility improved their customer experience. This is consistent with the benefits reported in ACRP Report 24: Guidebook for Evaluating Airport Parking Strategies and Supporting Technologies (Jacobs Consultancy 2009).

Fourteen airport operators surveyed identified that providing future demand data and improving utilization of parking facilities were also benefits of implementing an OBS; both reasons could be

considered as operational benefits. For instance, GSP successfully improved utilization by reducing demand and congestion at specific lots during peak times (Bauman 2024), while DFW increased utilization of underused facilities during off-peak periods by offering reduced online reservation parking rates compared to those for drive-up (Bandla 2024).

Additionally, 11 of the 17 airport operators surveyed noted that an OBS provided additional CRM data and insights. As discussed later in Chapter 4, airports such as PHX and DFW leveraged this data to build customer databases, develop customer profiles (or personas), and inform parking and pricing strategies. For example, if customer data indicate that more cost-sensitive leisure customers are traveling on weekends, the airport can discount the price to capture them from alternative modes of travel. Ten airport operators reported capturing customer data, and eight of those airport operators use the information to offer and/or push discounts for future parking reservations.

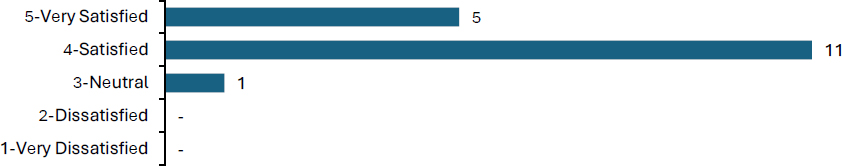

3.2.3 Most Airport Operators Surveyed Were Satisfied with Their OBS

As illustrated in Figure 3.3, 16 of the 17 airports were “satisfied” or “very satisfied” with their OBS. Some airports noted challenges with implementing an OBS. For example, as discussed in the case examples of Chapter 4, airports such as PHX, DFW, GSP, and MSY encountered technical and operational issues during OBS implementation. Despite these challenges, these airports were satisfied overall with their implementations, citing that the benefits and potential opportunities outweighed the initial transition and other difficulties.

3.2.4 Not All Airports Have Had Evidence of Improved Revenues as a Direct Result of an OBS

In the same survey question, respondents were asked to select applicable benefits of an OBS (Question 15), as seen in Figure 3.4. Almost half (eight of the 17) agreed that the OBS helped to generate increased revenues compared to pre-OBS integration.

As discussed in Chapter 4, some airports track general metrics (such as total revenue) but may not track metrics that provide specific evidence of revenue increases directly attributable to OBS implementation. Increased revenues may arise from upselling; for example, a customer initially chooses a value-oriented parking product, such as economy parking; after being offered to upgrade to a premium product, they choose a higher-cost product, such as parking in an adjacent terminal garage. As identified in the survey results, other airports have not yet used the functionality available within their OBS to push specific discounts or offers. These airports have focused on using the OBS to guarantee a customer parking space.

3.2.5 Airport Operators Reported a Wide Range of Capital and Operating Costs

When asked to estimate capital costs with implementing an OBS, a wide range of different responses were provided by the 17 applicable airport operators surveyed. Based on an analysis of the responses, the capital costs varied due to several factors:

- The OBS procurement: As discussed in Section 3.2.1, “Airports Employ a Variety of OBS Management Models,” some airport operators integrated the OBS into their parking management contract, making cost breakdowns difficult to ascertain as airports pay a total management fee. Other airport operators contract directly with the OBS vendor. In this case, most airports cited a fixed implementation cost ranging from $25,000 to $165,000.

- Integration of OBS with PARCS: Airports with existing systems that could incorporate or integrate with an OBS had no hardware cost requirements, while other airports may have had to upgrade their PARCS and/or add hardware such as QR code or barcode scanners (used for entry to and exit from the facility). Other airports took the opportunity to make other non-OBS-specific improvements while the OBS was implemented, such as installing parking guidance systems/monitoring bays and other improvements. Given that the scopes of these improvements vary significantly, a wide range of infrastructure costs were reported—from $42,000 to approximately $100,000. One airport reported costs of up to $22 million, but these costs included other costs not directly related to the OBS, such as PARCS upgrades, a parking guidance system, and other parking garage improvements.

Based on the survey responses, for airports that directly procure an OBS outside of the management contract, costs directly related to OBS implementation were reported between $25,000 and $165,000, with three airports reporting implementation costs of less than $50,000.

Operating costs also varied widely among the airports surveyed and were related to how the system was procured.

- For airports that have included OBS as part of the parking operator’s responsibilities, given that the airport pays a total management fee to the parking operator, specific operating costs related to an OBS may not be available.

- Four airports reported paying per transaction fees to the OBS vendor, with the fees ranging between $0.50 and $2.00. Some of these airports either fully or partially included these fees in the total cost of the parking reservation. One airport noted that transaction fees are based on a tiered pricing structure and vary depending on transaction volumes—the higher the level of transactions, the lower the per transaction fees. Another airport paid the OBS vendor a monthly minimum fee.

- Additional operating costs were reported from revenue management staff (either in-house or consultant), marketing, website management, and analytics by some airports. These airports included those that have had longer histories with using their OBSs as revenue-generating platforms, such as DFX, PHX, and others that are using the OBS platforms for more sophisticated uses beyond simply offering customers a guaranteed parking space.

3.2.6 The Minority of Airport Operators Surveyed Push Offers for Parking-Related Services

When asked if the airport offered other services or product offers beyond parking reservation products, four airports indicated that they did; all such services were directly related to the customer’s vehicle, including car wash and cleaning. In contrast to international counterparts, such as Vancouver International Airport or Manchester Airport Group (operator of Manchester International, London Stansted, and East Midlands), none of the airports surveyed have used their OBSs to offer other non-vehicle options, which may include premium security screening, common-use lounge access, or discounts for food and beverage orders (InterVISTAS Consulting, Inc. et al. 2021). This finding was corroborated by follow-up discussions with airport survey participants.

Although research from previous publications, such as ACRP Research Report 225: Rethinking Airport Parking Facilities to Protect and Enhance Non-Aeronautical Revenues (InterVISTAS Consulting, Inc. et al. 2021) and ACRP Report 24: Guidebook for Evaluating Airport Parking Strategies and Supporting Technologies (Jacobs Consultancy 2009), identified these services as potential benefits, the survey results indicate that they are not yet a common benefit offered at U.S. airports.